We help our Buy-side and Sell-side Clients evaluate transaction opportunities. Whether you are seeking to purchase strategic assets or sell a business unit or complete Enterprise, we provide the required analysis and support throughout the deal cycle. At each stage in the transaction process we provide Valuation and Risk Analysis, Marketing Assistance, Operational Review and Merger and Acquisition support.

Our primary goal during transaction processes is to identify key areas that affect the valuation and subsequent negotiation. Helping our clients understand negotiation strengths and weaknesses assists them in obtaining the best financial outcome along with an accelerated transaction.

Helping our Clients achieve their financial objectives is at the center of everything we do.

Investment Evaluation and Support

- Financial Analysis

- Operational Review

- Marketing Assistance

- Mergers and Acquisition Support

- Sarbanes Oxley 302 and 404 Compliance

Buy-side Assistance

- Our Consultants assist in the evaluation of past, present and projected future financial performance to determine likely valuation scenarios. We also help develop a strong negotiating strategy that limits downside risk and determines a purchase price range.

- We assist with post-acquisition strategies including merger integration analysis, risk assessments and “To Be” organizational design.

Sell-side Assistance

- We help Sell-side Clients prepare for and execute the transaction process by understanding, researching and documenting potential financial anomalies. These situations typically require historical accounting analysis in order to normalize financial results.

- As part of our financial analysis, we assist Clients to create EBIT and EBITDA calculations along with Asset, Earnings and Growth valuation scenarios.

- Our firm also helps Clients create Business Plans and Private Placement Memorandums that accurately portray operational strengths, comparative advantages and investment risks.

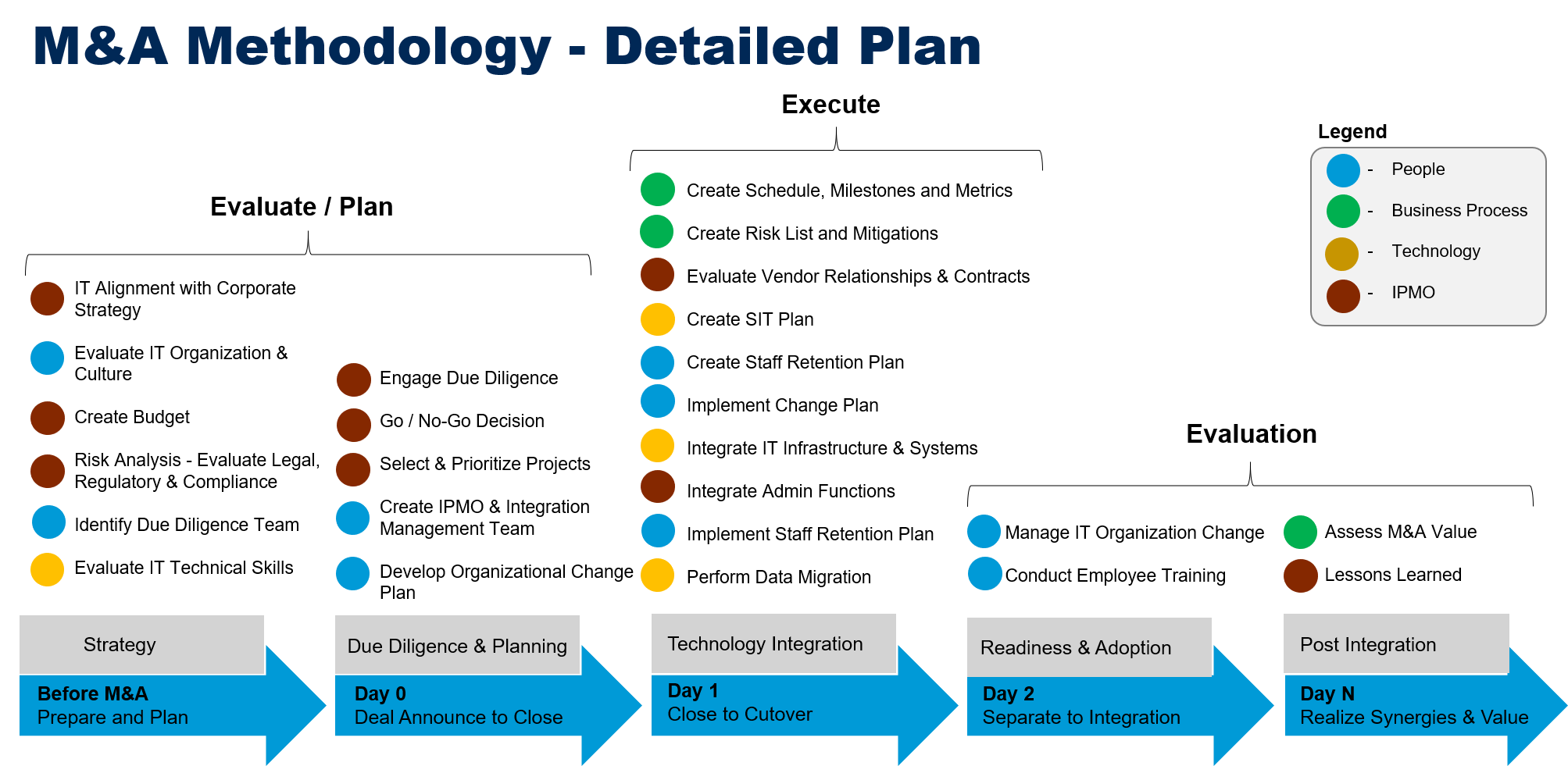

M&A Integrations

- HBSC offers full lifecycle M&A Services to helps to prepare, plan, integrate, and achieve synergy from M&A transactions. We help validate the synergy plan, structure the new combined operating model and assist with managing the complexity of two application portfolios and infrastructures.

- Because both application portfolios can have different maturity levels, we help rationalize a newly integrated architecture to meet the process needs of the merged entity.

- We also help rationalize and negotiate vendor sourcing contracts to optimize the new entities spend.